In a nutshell

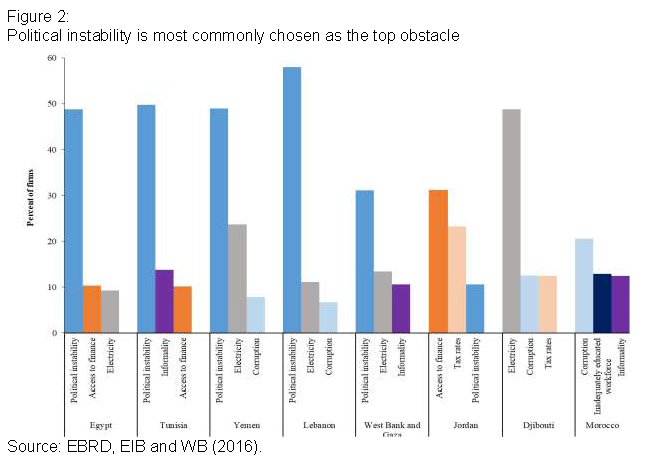

As might be expected, political instability is widely viewed as a constraint on firms’ productivity and competitiveness.

But there are many other issues that must be addressed to promote faster private sector growth and job creation.

These include tackling corruption and unreliable electricity supplies, facilitating firms’ access to finance, improving systems of education and training, supporting work opportunities for women and young people, and creating greater openness to international trade.

What are the main constraints on firms’ day-to-day business activities across the Middle East and North Africa (MENA)? To help answer this question, the European Bank for Reconstruction and Development (EBRD), the World Bank (WB) Group and the (EIB) conducted a joint enterprise survey in 2013-15.

The survey covered more than 6,000 firms across Djibouti, Egypt, Jordan, Lebanon, Morocco, Tunisia, West Bank and Gaza, and Yemen. Six key themes emerge from an in-depth analysis of these unique survey data (EBRD, EIB and WB, 2016).

Productivity

While labour productivity is somewhat higher than in similar emerging markets, total factor productivity (TFP), which measures the efficiency of use of other factors besides labour, lags. In all countries but Jordan, Morocco and Yemen, above-median labour productivity goes hand in hand with below-median TFP.

This indicates that while labour is used somewhat efficiently, when all factors are taken into consideration, firms are less productive. In other words, higher levels of labour productivity are achieved at the expense of an over-reliance on capital and intermediates. Larger firms in particular spend more on capital than labour inputs.

Yemen stands out in a negative way: firms are characterised by low labour productivity and low TFP. In contrast, in Morocco, relatively high labour productivity is also associated with relatively high TFP, indicating a comparatively efficient firm population.

Engagement in international trade

Many firms engage in international trade, but they are mostly small and medium-sized enterprises (SMEs) and do not reap the benefits in terms of size and productivity premia. One in four manufacturers in the MENA region directly exports goods abroad, but almost 80% of them employ fewer than 100 people.

‘Superstar’ exporters have similar productivity margins as elsewhere, but the bulk of other exporters lag behind. In fact, small player exporters are even less productive than non-exporters, yet they persist in the market.

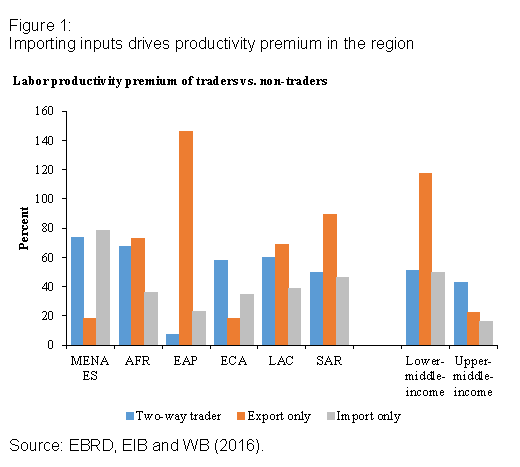

Those with consistently higher premia are importers, consistent with gains from better access to foreign technology and participation in supply chains (see Figure 1). The latter is also associated with higher likelihood of introducing new products and processes.

Tunisia is a case in point: it has the highest proportion of firms that both export and import in MENA and it is well integrated in global value chains. Moreover, a higher percentage of Tunisian firms are engaged in innovation than in the MENA region on average; this may be related to knowledge transfer from the country’s partners in global value chains.

Business constraints

Many firms are severely affected by political instability, corruption, unreliable electricity supply and inadequate access to finance (see Figure 2). Firm innovation and growth are also constrained by barriers to trade and a scarcity of appropriately trained workers.

In many places, there is a striking disconnect between firms and formal financing channels, with the result that firms are simply discouraged from seeking external finance, inevitably reducing their growth potential. Inefficiencies in the business environment are felt disproportionately by SMEs.

Credit constraints

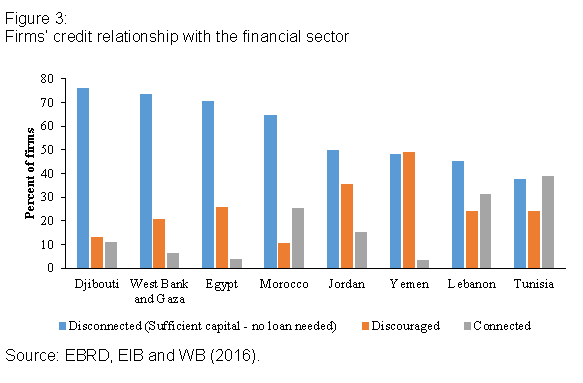

An unusually high share of firms at first sight appears not to be credit-constrained. But this is not driven by successful loan applications; instead, many firms report that they have enough capital and thus do not need a loan. Indeed, a significant share of firms that are not credit-constrained has disconnected from the banking sector altogether (see Figure 3).

This share is particularly high in Djibouti, Egypt and West Bank and Gaza. In Egypt, 40% of formal private sector firms do not even have a checking or savings account and therefore do not use the financial system even for payment services, suggesting that the disconnect is structural.

Disconnected firms resemble credit-constrained firms: they are small, less likely to plan for expansion and have a low propensity to invest. Further analysis suggests that firms are less likely to disconnect from the banking sector if nearby banks accept movable assets as collateral.

Employment

Manufacturing and exporting firms play a comparatively large role in providing employment, with the retail sector lagging behind. With the exception of West Bank and Gaza, the largest share of private sector jobs is in large firms.

The relatively small share of employment in SMEs is not explained by a relative lack of SMEs. Rather, firms in the MENA economies tend to be small and stagnant: few firms expand or downsize over time. Of the firms that were small in 2009, 93% were still small in 2012. Only 7% grew beyond 19 employees in 2012. Similarly, 82% of medium-sized firms and 91% of large firms remained in the same size category.

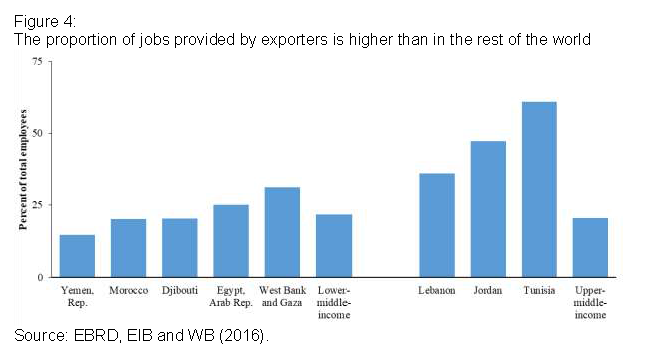

Exporters account for a higher proportion of formal jobs in the region than elsewhere in the world, more so in the relatively rich economies of Jordan, Lebanon and Tunisia than elsewhere (see Figure 4).

Skills

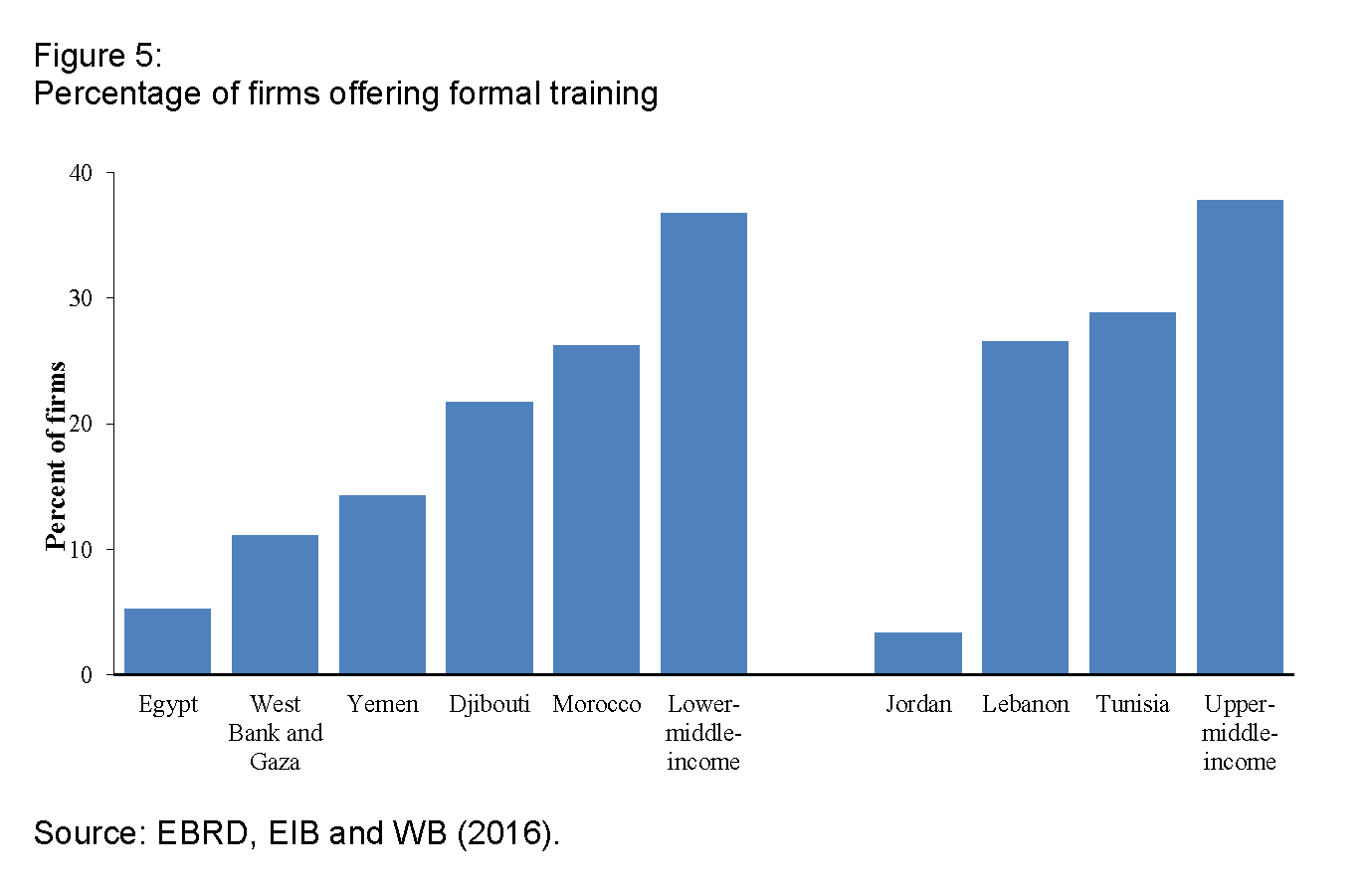

Skill shortages are a concern for those firms that have the highest growth potential. Even though education systems have failed to provide the necessary skills required by the private sector, the intensity of training provided by firms is low compared with similar countries (see Figure 5).

For example, only 5% of Egyptian firms offer formal training, far lower than the MENA average of 17%. The difference is driven primarily by the low percentage of SMEs providing formal training for their employees – only 2% and 6% of them do so, compared with 12% and 23% in the MENA region on average respectively.

Further reading

EBRD, EIB and WB (2016) What’s Holding Back the Private Sector in MENA? Lessons from the Enterprise Survey.

All MENA Enterprise Survey data are freely available for researchers to use: http://ebrd-beeps.com/