In a nutshell

Lack of fiscal space prohibited the government from the conduct of proper and timely fiscal policy; procyclicality worsened the sustainability of public debt, and automatic stabilisers are a crucial factor to countercyclicality.

Monetising government debt seems to be a viable option for the government; devaluation has the potential to improve the government's primary balance and to reduce the level of public debt, but it will have a devastating effect on ordinary citizens.

The government has had a free hand on the conduct of fiscal policy for over two decades: external borrowings will bring the long-awaited fiscal discipline, but can they be accepted and implemented?

Lebanon is a highly dollarised, small and open economy that is exposed to internal and external shocks. It has a high level of public debt, a high debt ratio and a persistent deficit in the overall primary balance.

The high public debt and persistent overall deficit have constrained the government’s actions during economic downturns in which its ability to conduct fiscal policy has been weak. The structure of public debt and the composition of the creditor base have added more complexity to the Lebanese economy.

Consequently, the government faced a trade-off between countercyclicality in the short term and fiscal sustainability in the medium and long term. The government chose the latter, which has had a devastating impact on the performance of the entire economy. The strategy has manifested itself in the events in Lebanon since late 2019.

Sustainability of public debt

Defaulting, monetising or restructuring the debt obligations to adjust to solvency conditions is very problematic and costly. Defaulting had dire consequences for the economy. Defaulting limited the government’s access to future financing, depreciated the currency and undermined the financial health of domestic creditors. Monetising, on the other hand, generated hyperinflation and had a catastrophic effect on the daily lives of ordinary people.

Restructuring the public debt proved to be a short-term solution. For example, the government has decreased its share of short-term Lebanese treasury bills to total debt. Consequently, the short-term debt as a percentage of total debt dropped from a high of 58% in 1996 to 2.3% in 2015. Subsequently, gross financing needs fell from a high of 25.35% of GDP in 1996 to its lowest level of 3.7% in 2014.

This strategy mitigated the liquidity risk. Notably, it has been difficult for the economy to generate enough liquidity to enable the government to meet its debt obligations. Nonetheless, the strategy generated higher debt service in the long term.

Furthermore, debt is sustainable if a country does not restructure, default or renegotiate its debt. In addition, if a stable and declining debt-to-GDP ratio is associated with a high risk of default or a high level of debt, then the debt is deemed to be unsustainable.

For example, from 2007 to 2011, the debt level in Lebanon was on an upward trend, but the debt ratio dropped from 183% to 131% of GDP. Despite the improvement in the debt-to-GDP ratio, the public debt was deemed to be unsustainable.

In addition, despite deteriorating economic conditions and contrary to predictions, the Lebanese economy survived for many years and exhibited signs of recovery. For example, in the period 2007-12, the debt-to-GDP ratio dropped from a high of 183% to 131%, real GDP registered an increase of 10% in 2009 and the trade deficit improved from 43% to 31% of GDP.

This progress indicates that the prospect of economic recovery is strong and that with strong political will and accommodating external conditions, Lebanon’s public debt and fiscal deficit can be adequately sustained.

Fiscal discipline and cyclicality

The apparent lack of fiscal response to changes in economic needs was caused by the lack of fiscal space available for the government to expand when fiscal expansion was severely needed. It is also explained by the policy that aimed to achieve medium-term objectives of fiscal sustainability at the cost of the short-term goals of countercyclicality or economic stability.

Lack of fiscal discipline by the government is attributed mainly to the composition of the creditor base. The creditor base, which consists mainly of resident lenders, motivated the government to have a free hand in the conduct of fiscal policy.

Resident lenders relieved the government from the fiscal discipline that could have otherwise been imposed by non-resident lenders. For example, in 2017, the government yielded to political pressure by increasing wages and compensation to public employees. Although the policy was countercyclical and needed, it further deteriorated the primary government balance.

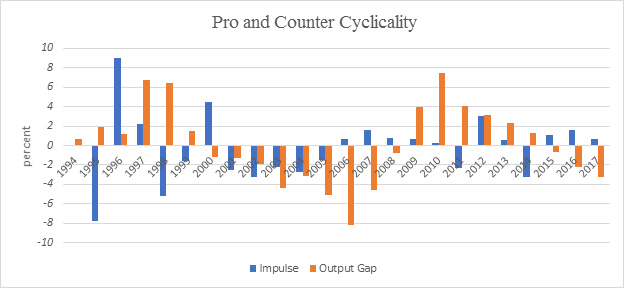

Procyclicality proved to have a devastating effect on debt sustainability. Consecutive years of procyclicality for the period 2001-06 (see Figure 1) led the debt-to-GDP ratio to reach an all-time high of 183% in 2006. Given the current economic and financial crisis that Lebanon is enduring, procyclical fiscal policy in the form of increasing taxes or cutting wages will have devastating consequences for the economy.

Figure 1: Pro and countercyclicality

Sources: calculated by the author by using raw data taken from the IMF: WEO and IFS

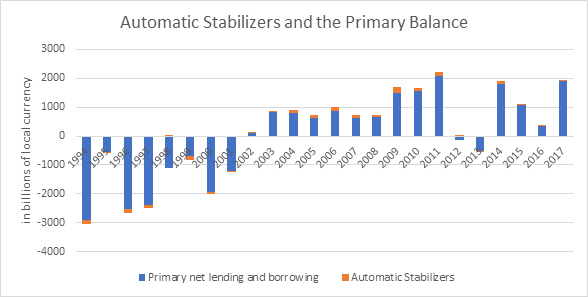

A proposed solution to countercyclicality is the triggering of automatic stabilisers. Automatic stabilisers are countercyclical, and they have the potential to decelerate the fiscal deficit and accelerate the fiscal surplus.

As the primary balance in Lebanon registered a surplus of 1.8 trillion pounds in fiscal year 2014, automatic stabilisers improved the primary balance by 5.5% or the equivalent of 105 billion pounds. Automatic stabilisers also decelerated the deficit by 3.9% or the equivalent of 20.3 billion pounds in fiscal year 2013 (see Figure 2).

Automatic stabilisers that consist of welfare programmes are desperately needed to stabilise the economy, particularly in the presence of Covid-19 and the global economic recession that has followed. Unemployment insurance, lower taxes and compensation to public and private sector employees are countercyclical and crucial for combating recession and reducing social unrest.

Figure 2: Automatic stabilisers and the primary balance

Sources: Automatic stabiliser calculated by the author by using raw data taken from the IMF: WEO, IFS and GFS

Cost of devaluation

One of the choices available for the government is to devalue the currency to monetise its debt-service obligations. But knowing that 35% of the government debt is in foreign currency, devaluation will increase foreign debt liability and decreases local currency debt liability. Henceforth, devaluation has the potential to lower the public debt and the debt ratio, but it will erode bank accounts of local currency depositors and savers.

Moreover, if the government adjusts its revenue to the newly established exchange rate but fails to adjust its expenditures, the strategy could improve the government’s primary balance, but it will stir more social unrest and further widen the gap between rich and poor.

External borrowing

The government can resort to the outside world for borrowing. Doing so will deprive the government of the fiscal freedom that it has been enjoying for over two decades; foreign lenders will be most likely to impose fiscal discipline that is unlikely to be implemented or even accepted by Lebanon. Although borrowing in foreign currency lowers the cost of servicing the public debt, it can lead to insolvency and illiquidity.

External borrowing will further increase the cost of servicing the public debt. As long as the debt service keeps increasing, the economy will deteriorate further. The high opportunity cost of servicing the public debt revealed itself in the deterioration of essential citizens’ needs, such as medical services and a cleaner environment.

Policy recommendations

In light of the uncertainty surrounding the Lebanese economy, loss minimisation seems to be the best strategy. The government should keep a close watch on the central bank’s foreign exchange reserves. Reserves are crucial for importing the countries basic needs, ranging from fuel to grains and medicine. An adjustment is also needed for capital control. Departing capital will put more pressure on the local currency to depreciate.

Fixing the disequilibrium in the balance of payments is equally essential, particularly the deficit in the trade balance. The trade deficit is a critical destabilising factor for the balance of payments and a primary cause of the current account deficit; it reached 42% of GDP in 2008. Moreover, a stimulus package should be given to small and medium enterprises to encourage exports, particularly in the agriculture and small manufacturing sectors.

Furthermore, the full capital control imposed by the government, and the central bank’s full control over the conduct of monetary policy, created a quasi-foreign exchange rate market that spiralled out of control. Instead, the government should have allowed capital outflows by the same proportion as that of the exchange rate devaluation.

Finally, the government could have negotiated better deals with resident lenders, particularly the banking sector. Had the banking sector forgiven the government some of its debt obligations, specifically the foreign currency debt, the exchange rate could have stayed under control. Although monetising lowers the government’s public debt, it erodes people ‘s savings and stirs more social unrest.

Further reading

Kassim M. Dakhlallah (2020) ‘Public Debt and Fiscal Sustainability: The Cyclically Adjusted Balance in the Case of Lebanon’, Middle East Development Journal.

Kassim M Dakhlallah (2019) ‘Reserve Adequacies and the Determinants of Foreign Exchange Reserves: An Empirical Analysis Through the Vector Error Correction Model’, Review of Middle East Economics and Finance.